- Quickbooks accountant online payroll login how to#

- Quickbooks accountant online payroll login update#

- Quickbooks accountant online payroll login password#

Quickbooks accountant online payroll login update#

Update the amounts to match the GL Report provided in your reports file. Adjust the Journal Number enter either check date or pay period end date as the entry date depending on your accounting method Below is an example using ASAP's General Ledger (S183) Report. Step 2: use the Journal Entry Template you named "Payroll" and reference your payroll reports. Give the Template a name such as "Payroll'.

Select 'Journal Entry' as the Transaction Type, hit OK Select "NEW" from the upper right hand corner of screen click on the Settings Menu in the top right corner of your QBO account Step 1: set up a Journal Entry in QBO as a Recurring Transaction: Option 1: Journal Entry as a Recurring Transaction

Option 2: Custom Import File or API Sync.Option 1: Journal Entry as a Recurring Transaction.If you are a subscriber to one of ASAP's accounting packages, this entry is likely already being performed.

Quickbooks accountant online payroll login how to#

How to Enter Your Payroll into QuickBooks Online : In this article we will provide an example of how you can enter your payroll transactions into your QuickBooks Online account for the proper recording of wages, employer tax expense, net checks, and associated transactions related to payrolls being generated outside of the QuickBooks payroll application.

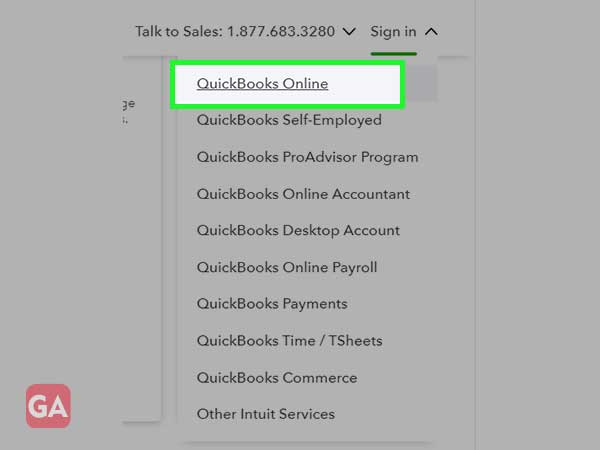

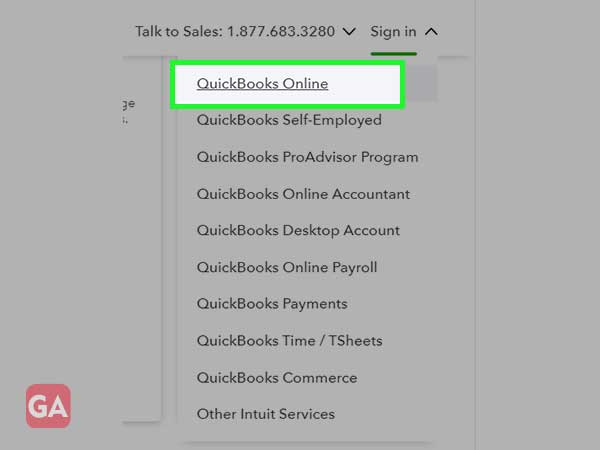

Next time you want to access the ViewMyPaycheck Company View, simply go to and sign in with your Intuit account ID and password.Payroll Journal Entry for QuickBooks Online. Quickbooks accountant online payroll login password#

In the QuickBooks Payroll window, enter the same Intuit account ID and password that you used to sync your QuickBooks company and click Sign In. In the Payroll Cloud Services window, confirm that the ViewMyPaycheck option is selected and click Access Company View. Click Employees > Manage Payroll Cloud Services. If you have questions about Sync Manager, search the QuickBooks Online Help for Set up Sync Manager. When sync is complete, close the Intuit Sync Manager window. In the Intuit Sync Manager window, sign in with the Intuit account ID and password you used for Intuit Payroll. (QuickBooks 2012) Click Online Solutions > Set Up Intuit Sync Manager. (QuickBooks 2013 and later) Click File > Set Up Intuit Sync Manager. Sign in to your QuickBooks company as the admin. To get administrator access to ViewMyPaycheck, the primary Payroll Administrator for the QuickBooks company needs to sync the company with the Intuit cloud services and then connect the company to ViewMyPaycheck. Important! The Company View is available only to QuickBooks for Windows employers with administrator access to ViewMyPaycheck. To do so, click the gear icon in the upper-right corner of the window and then click Switch Company. Toggle between companies, if your Intuit account includes multiple QuickBooks for Windows companies with access to ViewMyPaycheck. To do so, click the gear icon in the upper-right corner of the window and then click Preferences. You can set up ViewMyPaycheck so employees don't see their pay stubs before payday. Click an employee name to see the employee's paychecks in ViewMyPaycheck. See a list of employees and click the column heads to re-sort the list by employee name, hire date, or employment status. Search for individual employees in the Find an employee field. In the Company View window, administrators can:

0 kommentar(er)

0 kommentar(er)