In fact, in some states, receiving direct deposits can be included as a condition of employment.įirst, keep in mind that the "general rule" is that business owners must issue a Form 1099-MISC to each person to whom you have paid at least $600 in rents, services (including parts and materials), prizes and awards or other income payments. Yes, you can require an independent contractor, direct employee, or any other type of employee to use direct deposit in place of a check.

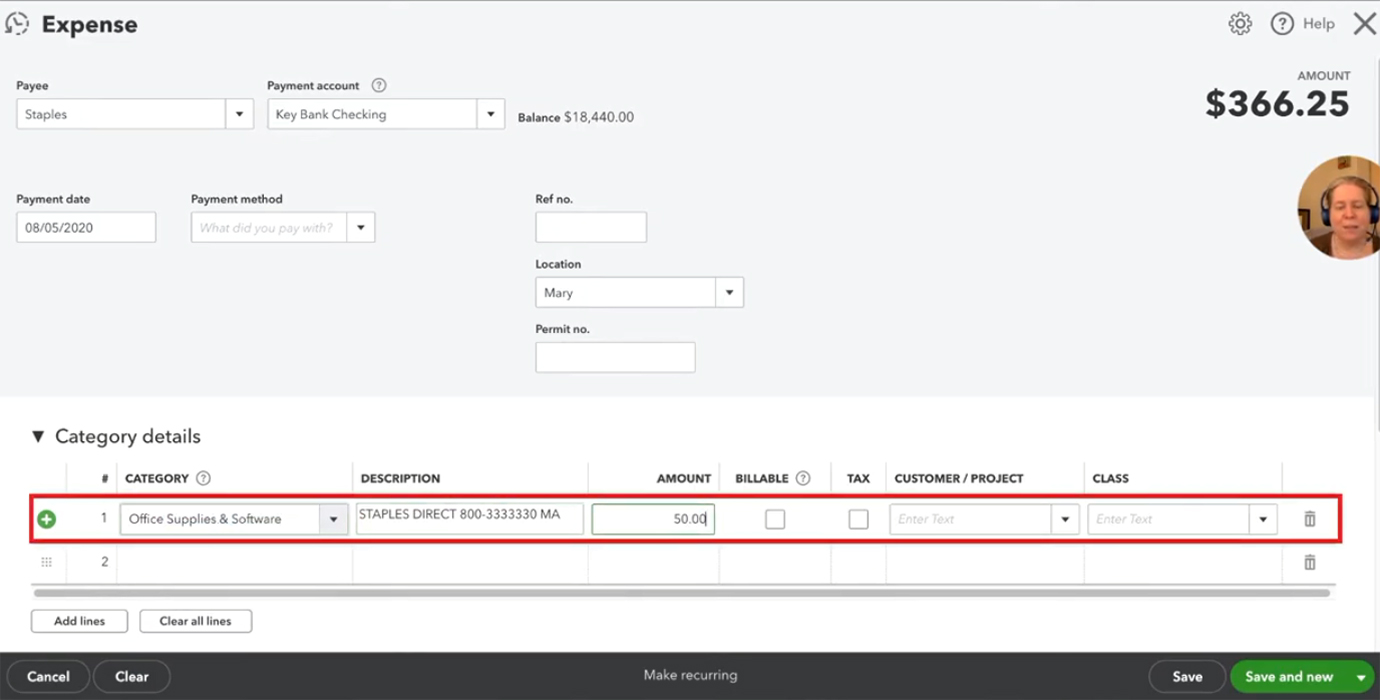

Similarly, it is asked, cAN 1099 employees get direct deposit? In the Categorize payments to contractors (or 1099 vendors) window, select the types of payment you made.Review your company information, and click on Next.Go to Expenses on the left panel, and select Vendors.One may also ask, how do I record 1099 expenses in QuickBooks? Pay any backup withholding that you withheld to the IRS.

This will provide you with all their identifying info. Have your contractor fill out a Form W-9.Similarly, it is asked, how do I pay a 1099 employee? We will learn to generate and analyze both the balance sheet and income statement reports by class.

How to enter personal expenses in quickbooks trial#

Enter the amount of money you owe the independent contractor in the field for "Amount Due." This is a project-based course that will use the free trial version of QuickBooks Enterprise to track multiple business financial data as well as personal financial data in one QuickBooks Enterprise file.Select the name of your independent contractor from the drop-down box next to the "Vendor" field.you message her again, then realize it has only been an hour. you do not remember assigning them to accounts. Our bookkeeper doesn't have the best consistency when it comes to categorizing expenses, so the end of year every year, I have to go back in and audit the book, so we can plan for the next fiscal year. the expenses are already assigned to accounts in quickbooks. Point to the "Vendors" menu and select "Enter Bills." Hey guys, like the title says, finally got our 501(c)(3) determination letter from the IRS.

0 kommentar(er)

0 kommentar(er)